Among all the other industries – Fintech is the one industry where technology is reshaping the way people do business. Gone are the days of manual processes and static reports, we’re in the era of the fintech revolution.

At the heart of this transformation are Data Visualization and Business Intelligence. These tools have evolved from being nice-to-haves to must-haves in the toolkit of every stakeholder navigating the complexities of financial data.

In today’s fintech landscape, the adoption of Data Visualization and Business Intelligence (DV and BI) is not just advantageous, but a compelling necessity!

Data Visualization and Business Intelligence experts are invaluable assets in the fintech world. As the demand for data-driven solutions and Fintech Software Development Services continues to grow, the importance of these experts will only increase in the years to come.

Yet, amidst their widespread use, a critical question lingers – are Business Intelligence and Data Visualization in the Finance Industry truly essential?

Let’s explore their top contributions, analyzing why they matter and what potential gaps might exist without them.

Contributions made by the Data Visualization in Finance Tech Industry.

Technology plays a crucial role in driving the success of Fintech and as the industry grows, the need for innovative solutions becomes more pressing.

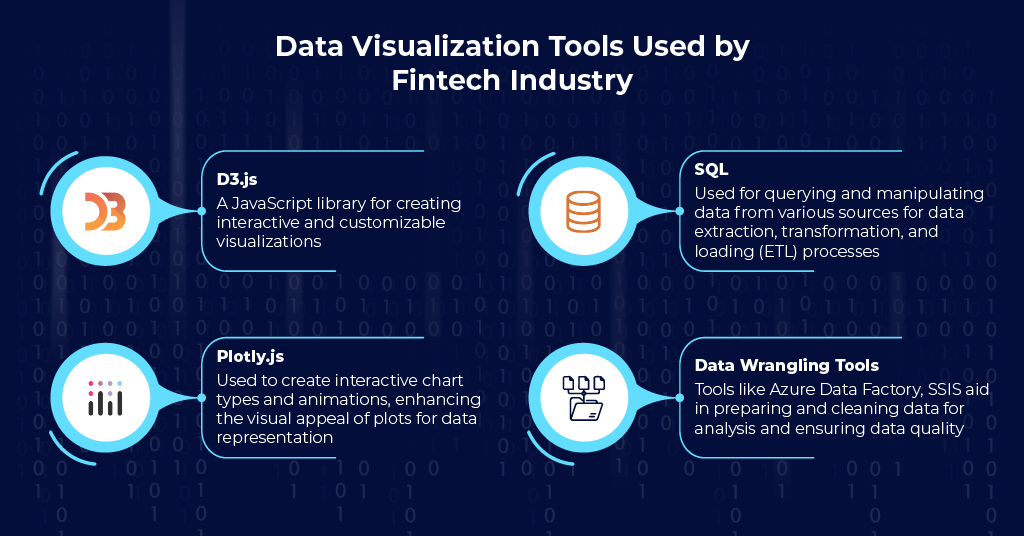

Before we head further, let’s have a quick look at some Data Visualization tools that the Fintech industry is leveraging.

Amidst these advancements, Data Visualization and Business Intelligence stand out as consistently utilized technologies.

These two technologies have made several contributions over the years such as –

1) Enhanced Decision-Making

Quick, well-informed decisions are crucial in Fintech’s ever-changing landscape!

How DV Helps – A perfect example is “PayPal”, which utilizes Data Visualization Tools to transform transaction data into visual dashboards. This allows executives to quickly assess transaction patterns, respond to market changes, and optimize decision-making processes.

However, without DV, decision-makers may struggle to analyze vast transaction data manually, leading to delays and missed opportunities

2)Improved Customer Insights

Customer preferences and understanding are fundamental to Fintech’s success!

How DV Helps – Fintech giant “Square” employs DV to analyze customer transaction data visually. This aids in identifying trends, preferences, and tailoring services.

For instance, Square’s DV efforts revealed increased demand for contactless payments during the pandemic, influencing their service offerings.

However, without DV, companies like Square might offer generic services, missing vital customer insights, and impacting customer engagement.

3)Stronger Fraud Detection

Security is the top priority for Fintech!

How DV Helps – Capital One leverages DV to detect anomalies in transaction patterns. By visually identifying unusual activities, Capital One enhances fraud detection capabilities, protecting both the company and its customers.

However, Without DV, fraud detection may be less efficient, leading to financial losses and damaged trust with stakeholders.

4)Efficient Risk Management

Daily risk management is essential for dynamic markets like Fintech, a minute mistake can ruin a lot!

How DV Helps – Wealth Front, a robot-advisor, uses DV to analyze market risks visually. This aids in proactive decision-making to mitigate potential losses. For instance, DV helped Wealth Front adjust investment portfolios during market uncertainties.

However, Without DV, companies may struggle to assess risks effectively, leading to reactive decision-making and potential financial setbacks.

5)Enhanced Transparency and Trust

Nothing can be done without Trust in the finance sector!

How DV Helps – DV allows companies like Robinhood to present investment data transparently. Visualization of financial data to track performance builds trust with users and investors, promoting stronger relationships.

However, Without DV, communication may lack transparency, risking erosion of trust and impacting relationships with stakeholders.

Contributions made by Business Intelligence in the Finance Tech Industry

A quick glance at the tech tools serving the industry.

1)Streamlined Operations and Cost Reduction

Efficiency is critical in a competitive environment like Fintech!

How BI Helps – JPMorgan Chase employs BI to automate data analysis, reducing manual tasks. This streamlines operations, saves time, and identifies areas for cost reduction.

However, Without BI, manual processes may lead to inefficiencies, increased costs, and a potential threat to long-term sustainability.

2)Predictive Analytics and Market Insights

Staying ahead is vital in Fintech!

How BI Helps – ETrade, a subsidiary of Morgan Stanley utilizes Business Intelligence tools for predictive analytics. By analyzing historical data, ETrade predicts market trends, providing users with insights to make informed investment decisions.

However, Without BI, companies may struggle to predict market movements, potentially missing opportunities.

3)Personalized Customer Experiences

Customer relationships matter the most for Fintech!

How BI Helps – Bank of America uses BI to analyze customer data and deliver personalized experiences. Tailored offerings enhance satisfaction and loyalty.

However, without BI, companies risk providing generic products and services, leading to a suboptimal customer experience and reduced loyalty.

4)Regulatory Compliance and Reporting

Compliance is a non-negotiable aspect of Fintech!

How BI Helps – BBVA, a Spanish multinational financial services company employs BI to automate regulatory reporting, ensuring compliance. This minimizes the risk of penalties and maintains a strong regulatory standing.

However, without BI, manual compliance processes may lead to errors, delays, and increased regulatory risks.

5)Data-Driven Culture and Continuous Improvement

Adaptability and innovation are the lifeblood of Fintech!

How BI Helps – American Express fosters a data-driven culture with BI. It enables employees at all levels to make data-driven decisions, promoting continuous improvement.

However, without BI, companies may struggle to leverage data for decision-making, hindering innovation and adaptability.

These instances go beyond showcasing how large corporations leverage technology; they are concrete evidence that, within the distinctive realm of

Fintech, individuals are increasingly taking help from Data Visualization Services and Business Intelligence Service providers.

It transcends mere technological applications; it is a testament to the transformative impact these tools have on enhancing the efficiency and human-centric aspects of our work in the dynamic field of Fintech.

Conclusion

In Fintech, where adaptability and innovation are paramount, DV and BI foster a culture of continuous improvement.

They empower organizations to navigate risks, build trust with stakeholders, and help businesses stay ahead of the curve.

The absence of these tools could leave Fintech companies grappling with data complexities, slower decision-making, and the potential loss of competitive edge.

Therefore, the answer to whether Data Visualization and Business Intelligence are essential for Fintech or Finance Tech Industry is a Resounding Yes!

These technologies not only enhance operational efficiency but also serve as catalysts for innovation, growth, and sustained success in this rapidly evolving industry.

Connect with our experts to discuss your Fintech Software Development needs!