“Change is the heartbeat of progress, and in the realm of business, adaptation is paramount to survival!”

As technology continues to reshape industries, digital transformation has emerged as the beacon guiding organizations toward a more efficient and interconnected future.

Yet, beneath the surface of this technological metamorphosis lies an untapped potential – the power to re-engineer business processes from the ground up.

In this article, we embark on a journey into the symbiotic relationship between digital transformation and business process reengineering.

By uncovering how digital transformation not only curtails excessive processes but also stimulates a profound reinvention of the organizational framework leading to digital process transformation.

We will unveil the gateway to enhanced productivity, innovation, and enduring success.

But first, we must understand the meaning of three terms that are essential to get the proper idea of the concept that has the potential to reshape the way businesses have been operating in the present landscape.

Digital Transformation

Digital Transformation is more than just adopting new technologies; it’s a cultural shift embracing innovation, adaptability, and customer-centricity.

By harnessing cutting-edge tech, businesses optimize efficiency, make data-driven decisions, and explore growth opportunities, creating a dynamic ecosystem that adapts to the modern world’s demands.

Business Process

The intricate web of business processes is the heartbeat of every organization’s operation.

These interconnected tasks, activities, and workflows form the lifeline of the company, enabling the delivery of products and services, satisfying customers, and achieving strategic objectives.

A well-orchestrated business process fosters productivity, reduces operational bottlenecks, and ensures resources are utilized optimally.

Understanding, optimizing, and streamlining these processes is key to unlocking an organization’s true potential.

Business Process Re-engineering

While digital transformation in business paves the way for technological integration, business process re-engineering (BPR) takes a bolder approach – a complete redesign of the organizational framework!

BPR challenges long-standing practices, questions conventional wisdom, and envisions a future state where operations are leaner, more agile, and customer-focused.

Spearheaded by top-level management, BPR entails eliminating redundant steps, reorganizing workflows, and embracing innovative technologies to achieve breakthrough outcomes.

It is a journey of transformation that can lead to amplified efficiency, competitive advantage, and lasting success in a rapidly changing market.

Now that we have a basic understanding of the three terms, let us explore a case study that will help in understanding the importance of adopting digital transformation practices and the consequences of not doing so!

The Case Study

Client – Insurance Brokers Firm | Service – Policy Document Provision

Introduction

An established Insurance Brokers Firm faced a critical challenge that threatened its efficiency in providing accurate policy quotations to clients.

The firm relied on an internal application designed for data collection that was used by the underwriters to get the data for policy quotation generation, but its limitations hindered seamless service delivery.

As the industry evolved and policy parameters became more complex, the firm faced inefficiencies and a cumbersome manual process.

Recognizing the need for a comprehensive solution, the firm collaborated with an IT company in India to undertake a transformative journey toward digital transformation.

Pain Points

Inaccessible Data – The existing internal application had limited data as it relied on manual data entry by employees, making it difficult to access and analyze critical information.

Time-Consuming Data Retrieval – Manually extracting data from hardcopy documents and entering it into the system was labor-intensive and time-consuming.

Inefficient Underwriting – The physical underwriting process led to delays in generating policy quotations, leading to excessive data calculations that impacted overall operational efficiency.

Complex Work Procedures – The firm’s legacy processes involved storing data in both the system and paper forms, leading to confusion, duplication, and time wastage. The lack of a unified data management system created inefficiencies in data retrieval and analysis.

Solution Journey

The team of developers embarked on a methodical solution journey, addressing the pain points and streamlining business processes through digital transformation.

Online Data Collection Form and Admin Section

- To overcome the issue of inaccessible data, the IT team developed a user-friendly online form that served as a front-facing screen allowing customers to add data directly.

- Behind the form, a vast software infrastructure handled the data processing and storage.

- The engineers also developed an admin section that the internal team could access to manage and update data in the centralized database.

Front-end Development and Process Evolution

- The development of the online data collection form raised questions about the existing offline process that had been in place for years.

- Recognizing the need for change and improvement, the IT team conducted a thorough analysis of the firm’s business processes.

- They found that the firm used to follow multiple steps, sometimes storing data in the system and sometimes in hardcopy files, leading to delays and inefficiencies.

- This insight drove the development of an admin panel and a comprehensive application that would streamline the underwriting process and eliminate unnecessary procedures.

Employee Training

- In addition to developing the application, the developers provided extensive training to the insurance broker firm’s employees.

- The training focused on using the application effectively to reduce excessive work processes and optimize the utilization of the new tools and features.

Comprehensive Application Development

- Equipped with a comprehensive dataset and understanding of the business processes, the developer’s team developed a one-of-a-kind application strategically designed to seamlessly integrate with the firm’s existing internal system.

- This application significantly enhanced the firm’s capabilities in generating accurate policy quotations based on the data collected.

Integration and Client Portal

- The data collected through the online forms and the admin section were processed and stored in the database back-end.

- With the development of new APIs, this data was seamlessly brought to the front end as resolved quotations.

- The application was successfully integrated with the existing system, enabling the organization to have a comprehensive internal solution for data storage and refinement.

- Additionally, the transformed application was converted into an accessible client portal, providing clients with an easy way to access their policy documents and quotations.

Transformative Outcomes

The digital transformation resulted in a remarkable transformation for the firm, enhancing its efficiency and driving business process re-engineering.

Work Efficiency Enhancement

Automation capabilities significantly reduced manual efforts and processing time for underwriters, resulting in quicker and more accurate policy quotations.

Accurate Quotations

The application’s data analysis process ensured the generation of precise policy quotations, tailored to each client’s unique needs.

Centralized Data Management

The centralized database ensured secure and efficient data storage, eliminating inefficiencies caused by scattered data sources.

Streamlined operations for clients’ team

- Moreover, the transformed application was converted into an accessible client portal, providing an enhanced client experience.

- Clients could now easily access policy documents and quotations based on their specific needs, leading to increased satisfaction.

- The integration of systems not only optimized internal operations but also enriched the overall working experience.

Clients experienced a seamless process, accessing policy documents based on their specific policies, leading to higher satisfaction.

Enriched Customer Experience

Along with streamlining the internal operations, the integration of the system also enriched the end customer experience, ultimately leading to greater client satisfaction.

Conclusion

Through a successful digital transformation journey, the Insurance Brokers Firm achieved a streamlined and efficient policy quotation process.

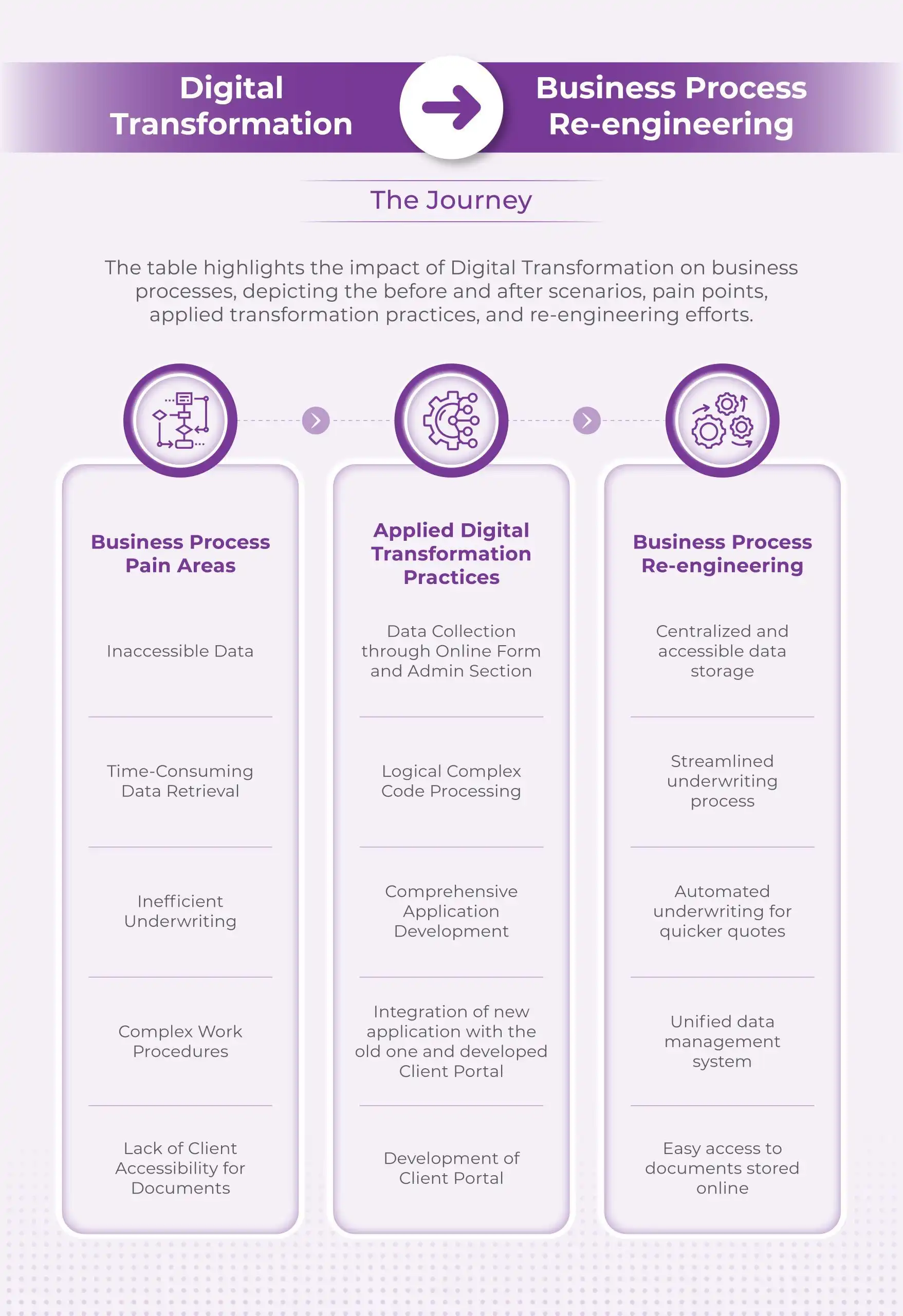

Here is a quick view that summarizes the process that underwent for this transformation.

The collaboration with the experienced team of developers resulted in significant improvements, reducing pain points and enhancing business processes.

The Final Note

This case study underscores the power of digital transformation services in minimizing excessive business processes and re-engineering essential operations.

By recognizing the need for a comprehensive solution, the Insurance Brokers Firm embarked on a transformative journey, collaborating with an IT company in India to overcome challenges and optimize its policy document quotations.

Business owners who are looking to improve their efficiency, accuracy, and customer satisfaction should take note of this case study as a compelling example of how digital transformation can effectively minimize excessive business processes and drive business process re-engineering.

The paramount significance of hiring a team that understands your business objectives and can develop transformative applications cannot be overstated.

It stands as the pivotal factor in driving positive change and unlocking your business’s full potential.

Embracing digital transformation practices is not merely an option; it is a strategic imperative for staying competitive and thriving in the ever-evolving business landscape!